Body corporate levies underpin the function of each community. Nobody really likes paying them,

but understanding how they are calculated, where they go, and what services they provide, may just

make you feel a little bit better about contributing your share.

Body corporate contributions, generally called levies, are the payments made by all lot owners

towards the operation of the body corporate. Similar to a tax they are a compulsory part of

ownership in a body corporate and are collected to pay for the maintenance and operating costs of

the development. The body corporate relies on levies to fund all of its operations.

It can be helpful to think of levies as a large number of smaller individual costs, bundled together

into one convenient payment. That is how levies are calculated and spent.

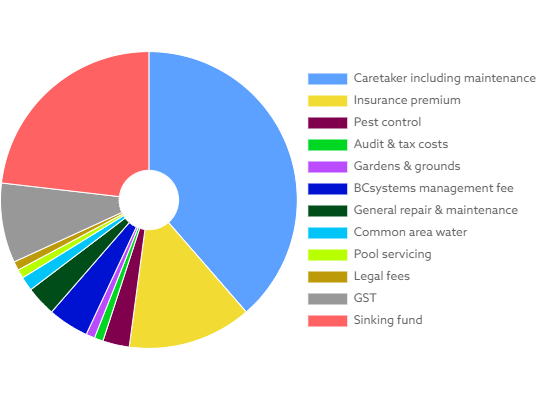

WHERE YOUR LEVIES GO:

Although every Body Corporate community is different, the below pie chart illustrates how the levies

are calculated and allocated in a typical scheme.

HOW ARE LEVIES CALCULATED:

The levies are set each year at the AGM, by a majority vote of all owners. Setting the levies is

relatively simple:

- The committee and the body corporate manager work together to prepare a budget

for the year’s expected operational costs. - The budget takes into account whether last year’s costs were over or under budget.

- The budget is then divided by the total number of lot entitlements.

- This shows the amount required for the year to pay for the body corporate’s

operational costs.

There is no profit margin on levies. If your body corporate comes in under budget, the saving is

rolled forward to offset next year’s levies.

If your body corporate goes over budget, then the difference must be picked up in next year’s levies